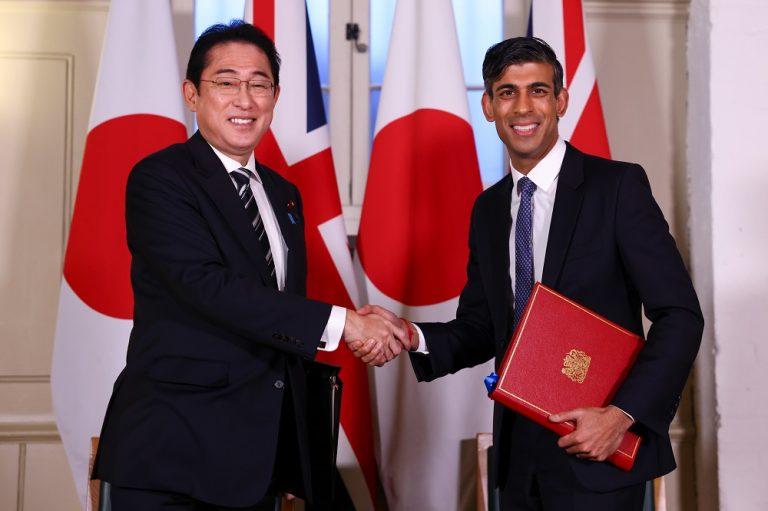

Leonardo completed the acquisition from Square Lux Holding II S.à r.l., a portfolio company controlled by funds advised by Kohlberg Kravis & Roberts & Co. L.P, of 25.1% of the shares in HENSOLDT AG (“HENSOLDT”), a leading German player in the field of sensors for defense and security applications, with an expanding portfolio in sensors, data management, and robotics, for a cash consideration of € 606 million.

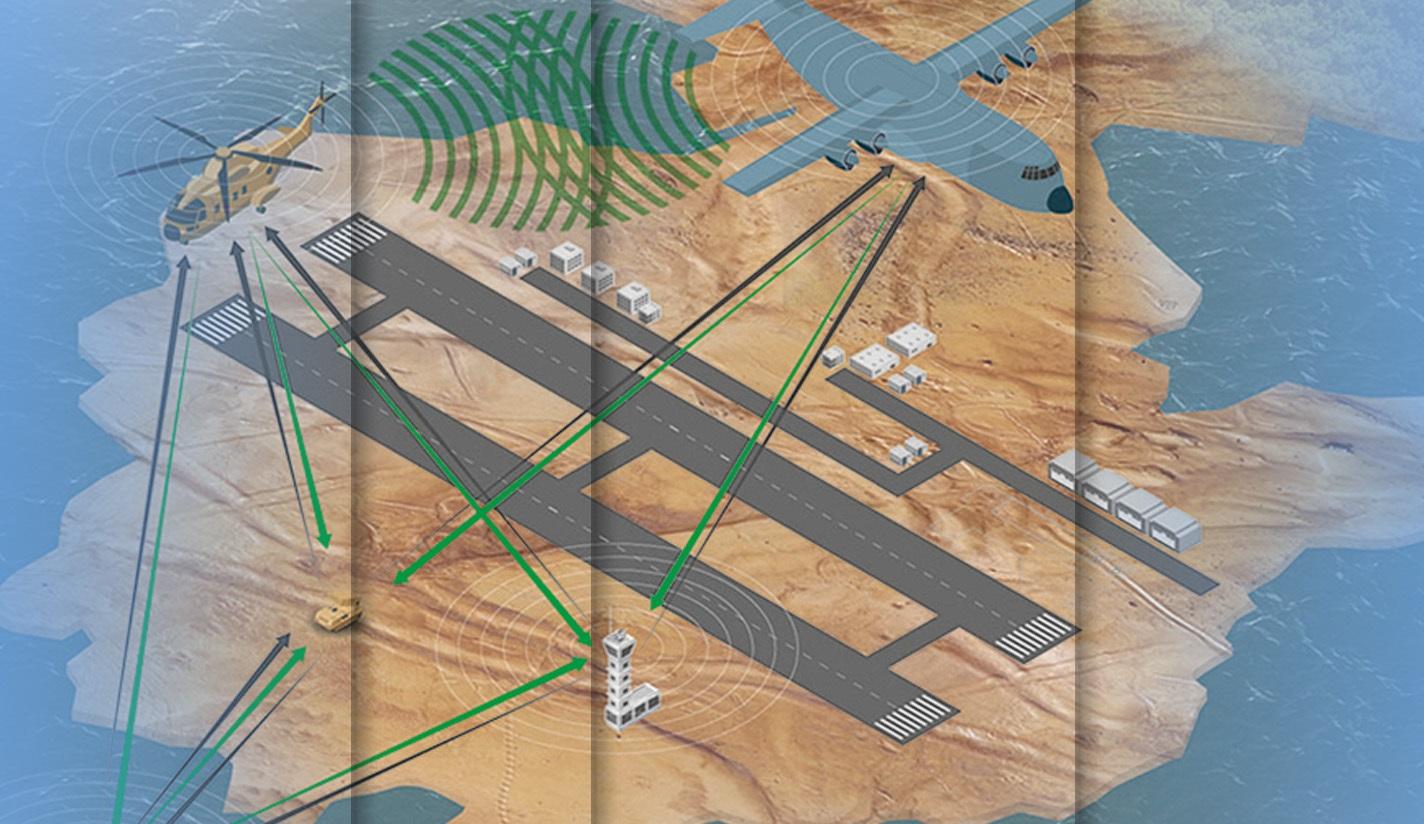

This investment will allow Leonardo to establish a long-term strategic presence in the fast-growing German defense market and to strengthen the long-standing partnership between the two companies through the definition of cooperation initiatives for the development of joint opportunities able to satisfy the most advanced requirements of domestic and international customers in the Air, Land and Naval domains, leveraging on a strong complementarity between the two companies in terms of geography, product portfolio, end markets, customers and suppliers.

This transaction is a step forward in helping to achieve Leonardo’s strategic objective of acquiring a leadership position in the European Defence Electronics market, as defined by the “Be Tomorrow – Leonardo 2030” Plan, and reflects Leonardo’s determination to play an active role in the consolidation process underway, also in the light of future cooperation programs in continental Europe.

With this transaction, Leonardo, thanks to its consolidated industrial presence in Italy, the United Kingdom, USA, and Poland, inaugurates a new strategic partnership with a leading industrial player in the Aerospace, Defence, and Security sector in Germany, which will contribute to the sustainable growth of the respective industries at the national level, while also guaranteeing strategic autonomy on key technologies to make a concrete contribution to the competitiveness of the European industrial base.